To prepare for selling covered calls, an initial purchase of 50 shares of Barrick Mining Corporation was made at $41.35 (20251128). Additional 50 shares are needed to reach the required 100-share position to write one standard covered call contract. This staged approach allowed for deliberate entry and ensured that position sizing remained intentional rather than rushed. When the full share requirement is met, the position could then be used to begin documenting the covered call process, including strike selection, expiration choice, premium collection, and outcome review. As with all trades documented here, this position is being used as part of an ongoing learning and journaling process. The focus remains on understanding execution, risk, and consistency rather than predicting outcomes, with each step recorded to improve clarity and decision-making over time.

Barrick Mining (B) was selected as a candidate for selling covered calls based on its position as a large, established company within the gold mining sector. As one of the world’s major gold producers, Barrick operates across multiple jurisdictions and has a long operating history, which provides a level of stability compared to smaller or more speculative mining companies. This type of underlying stock aligns well with covered call strategies, where consistency, liquidity, and defined expectations are often more important than aggressive growth.

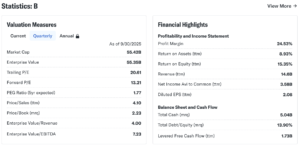

From a financial perspective, Barrick’s scale, balance sheet strength, and exposure to gold prices make it suitable for income-focused option strategies. Rather than relying on short-term price spikes, the stock tends to trade within identifiable ranges influenced by broader commodity trends, interest rates, and macroeconomic conditions. This behavior can support covered call writing by allowing premiums to be collected while managing downside risk through disciplined position sizing and strike selection.

Operationally, Barrick’s diversified mining operations and ongoing production provide a tangible foundation beneath the stock price. The company’s business model is rooted in long-term asset development and cost management, which helps reduce some of the volatility associated with single-project miners. For covered calls, this operational consistency supports the goal of generating income while holding shares that are acceptable to own if assigned or retained over time.

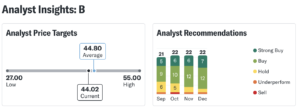

Ultimately, the decision to use Barrick for covered calls is less about predicting price direction and more about aligning the strategy with the characteristics of the underlying asset. This position is being documented as part of the broader trading journal to evaluate how covered calls perform over time on a real company with established operations, steady liquidity, and exposure to a sector that fits within a longer-term market framework.