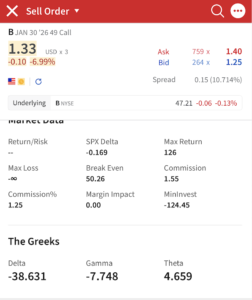

The first covered call was sold on Barrick Mining Co, using the January 30, 2026; Strike $49 call, marking the initial execution of the strategy after completing the 100-share position. This trade generated a premium of $1.33 per share, resulting in $133 in upfront cash flow, while setting a strike price above the purchase level to allow for additional upside if the stock rises. The option carried a delta of approximately -38% (62% chance of expiring worthless) low likelihood of assignment, and a theta value of 4.6 (option is losing approximate $4 per day due to time decay), reflecting the benefit of time decay working in favor of the option seller as the contract approaches expiration.

A covered call begins by placing an order labeled “sell to open” on a call option, which means selling the right for someone else to buy shares that are already owned. Because the shares are held in advance, the position is considered “covered,” reducing risk compared to selling options without owning the stock. This strategy is commonly used to generate income while holding shares.

Several option measurements, called Greeks, help explain how the trade behaves. Beta describes how much the stock tends to move compared to the overall market, which helps set expectations for volatility. Gamma shows how quickly the option’s price can change as the stock moves, while theta represents time decay, which benefits the option seller as the expiration date approaches.

Before placing the trade, a strike price, expiration date, and quantity are selected. The strike price sets the level at which the shares could be sold, the expiration defines how long the obligation lasts, and the quantity determines how many contracts are sold. These choices shape both the potential income and the risk of assignment.

Once the order is filled, a credit is received upfront, creating immediate cash flow from the trade. If the option expires worthless, the seller keeps both the premium and the shares. If the option is exercised, the shares are sold at the strike price, completing the covered call outcome.

Possible Covered Call Outcomes

📈 Stock rises but stays below the strike price:

The option expires worthless, the premium is kept as income, and the shares remain owned.

📈 Stock rises above the strike price:

The option is assigned, the shares are sold at the strike price, and the premium is still kept, resulting in a capped but known gain.

➡️ Stock shows little or no movement:

The option expires worthless, allowing the premium to be kept while continuing to hold the shares.

📉 Stock declines significantly:

The premium offers limited protection, and losses may occur due to the drop in the stock price, reinforcing the importance of risk management.

Explanation:

1) If the stock rises but stays below the strike price, the option typically expires worthless, allowing the premium to be kept while continuing to hold the shares and collecting income (Excellent).

2) If the stock rises above the strike price, the option may be assigned, meaning the shares are sold at the selected strike price while the premium is still kept, resulting in a capped amount which equates to “Opportunity Lost” (Good).

3) If the stock shows no significant movement, the option can again expire worthless, and the collected premium becomes income while the shares remain owned (Good).

4) The less favorable scenario occurs when the stock declines significantly, where the premium provides only limited protection and the overall position can experience losses due to the drop in the share price, highlighting the importance of selecting stocks that are acceptable to hold and managing risk carefully (Not Ideal).